Sometimes, it might be confusing to look at a day end after you have received an order or layaway. This could be a Sales Order (including those from your website), Special Order, or Layaways. These types of transactions are considered incomplete until they are marked delivered and therefore do not appear as sales on the day end. They do, however, appear in the Customer Deposits section. We’ll explain why in a minute.

Let’s look at an example:

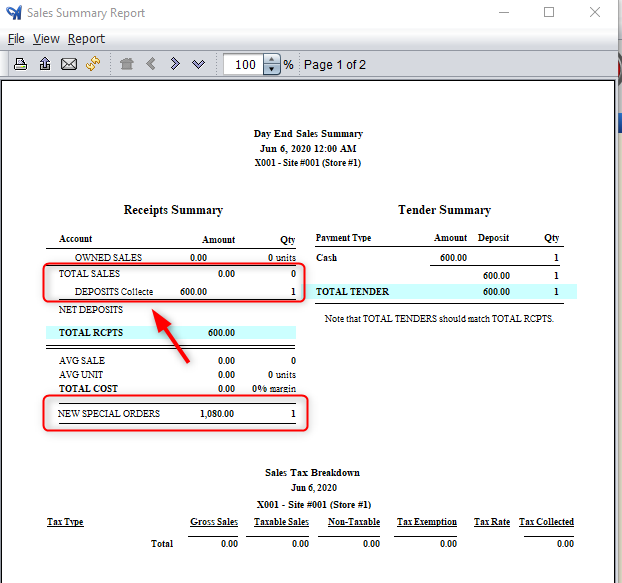

Two days ago, we took in a special order with a deposit of $600. To help make things clearer for this example, this is the only thing we did that day.

The day end looks like this:

Notice that the TOTAL SALES is $0.00, because the sale isn’t finished.

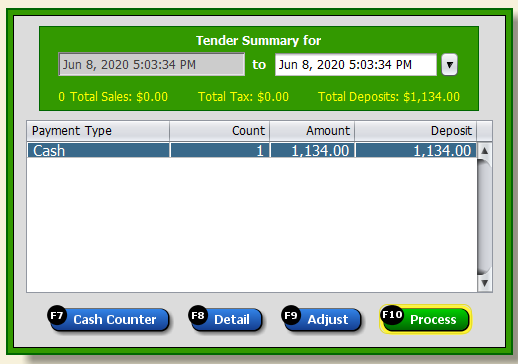

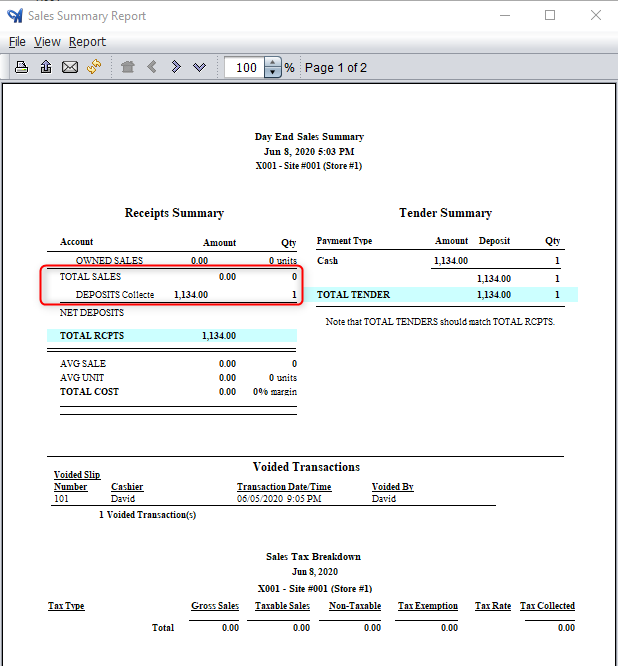

Now, yesterday we took the final payment for the order. Here’s what that day looks like. It is pretty much the same. Still, this is not a sale because the merchandise has not been given to the customer.

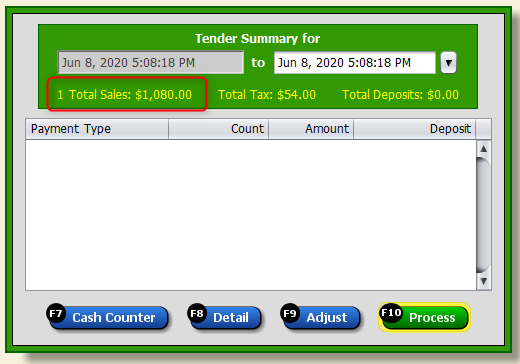

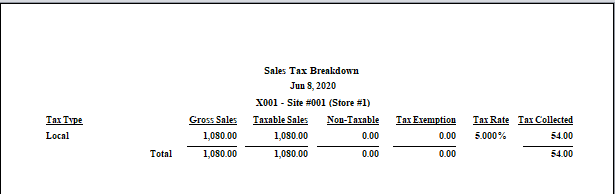

Now, the last step: the customer comes in to pick up the merchandise.

What happened? Deposits were accumulated into a “Deposit Holding Account” until the sale had been completed. Then when the merchandise was given or “delivered” to the customer, the money from the holding account was used to “pay” for the order. That is when the sale took place and was recorded, even though no money had changed hands at that point.

It isn’t about the money, it’s about the merchandise. The state does not care if you got paid or not, all they care about is when the customer received their goods. This can be defined as when the goods shipped, not necessarily when the customer received them. Consider the following scenarios and whether or not the tax is due.

- May 30th: A customer pays 100% of their order, but they don’t come until June 3rd to pick up the merchandise. Tax is due for JUNE, not May.

- May 30th: A customer takes home merchandise today. However, they will send a check to pay for it in June. Tax is due for MAY, not June.

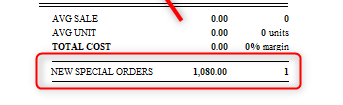

We realize that sometimes this can be frustrating when you want to show your sales for the month. But unless you are in an unusual sales commission situation, you are better off to just look at the “New Special Orders” section on the sales summary report. If you are trying to pay commissions or consignment payout on pre-sales, we highly recommend against it.

Background: We have consulted with many different accountants and CPAs across the country. The overwhelming consensus is that a sale isn’t a sale until the customer gets the merchandise. This is also in agreement with all sales tax laws we have referenced.

QuickBooks has many references to handling customer deposits.

“The company does not initially incur any sales tax liability when it accepts a deposit from a customer. This liability is only created once the company delivers under its contract with a customer and converts a deposit into a sale transaction.” – accountingtools.com

https://www.accountingtools.com/articles/what-is-a-customer-deposit.html