In a destination-based state, sales tax is collected based on the buyer’s location. That means you collect sales tax based on your customer’s state and local tax rates. You also remit the tax to your customer’s state and locality.

Before configuring any settings for this in Artisan, double-check with your accountant to understand which states you need to collect tax for. Laws and regulations regarding tax change from time to time, so it’s important to stay up to date on that information. Some stores don’t meet the threshold or volume of sales that requires them to pay tax for their state. If you do collect sales tax, you need a tax certificate from the state.

Setting Up Destination-Based Sales Tax in Artisan

Click on “Tools” and “Program Options.”

Click on the “Business and Financial Settings” section. Open “Sales Tax Settings.”

Click on “Sales Tax Rates.”

If you don’t already have a Sales Tax record for this state, create it now by clicking on “Add” and filling out the Short Name, Long Name, and Tax Style.

In the “Destination-Based Tax for These States” section, enter the state abbreviation that you want to include. Separate multiple states by commas.

Press “Save.“

To see this in action, let’s look at an example on the Sales Screen. Let’s say we added the state of New York to our Destination-Based tax list.

If we head to the shipping tab and select New York for the state, we’ll notice the tax rate has updated in the lower right corner.

You can also select the tax type from the “Tax” dropdown. Notice how it changes for each state.

New York selected:

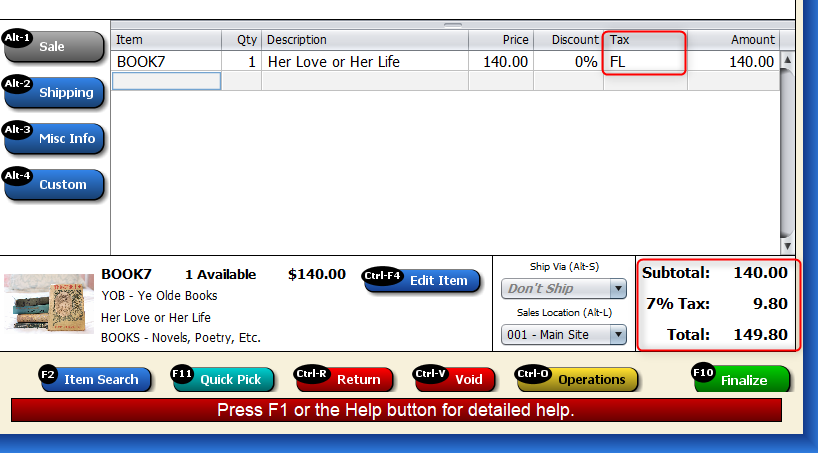

Florida selected:

Taxable Shipping

If your store uses taxable shipping, follow these steps.

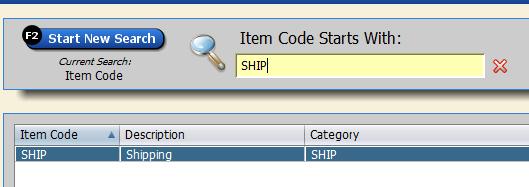

Look up “ship” in the item record screen to pull up the “Shipping” item record. Edit it.

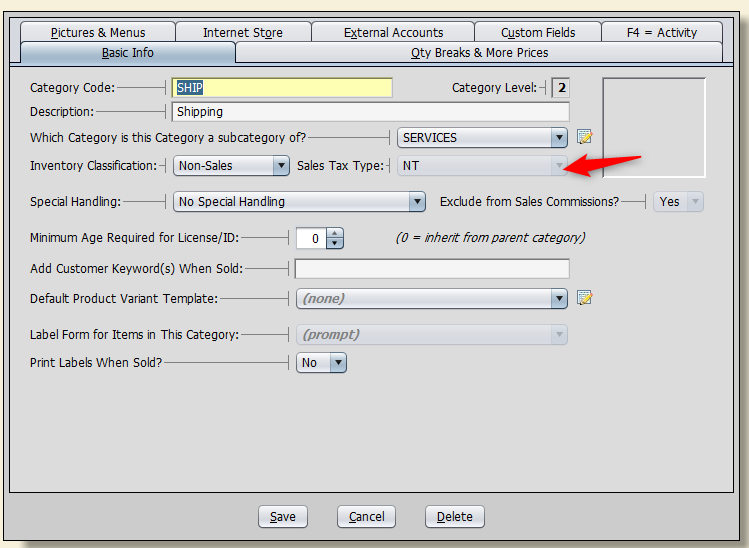

Its category is set to “Ship.” Edit that category.

You’ll see that its Sales Tax Type is set to “No Tax.”

To fix this, we’ll create a new category called “Taxable Shipping.” Under “Inventory Classification,” select “Services” and leave the “Sales Tax Type” as default.

Edit the shipping charge item record and select the new category you created.